Natural Gas Is Heading to 1997 Levels, Should Stay There Awhile

Seeking Alpha, April 27, 2009

In the middle of this decade, E&P companies were spurred on by rising commodity prices and easy credit to find and develop new sources of domestic natural gas–most notably shale gas. The forces that enabled this phenomenal growth in domestic gas production–the great asset and credit bubble–have vanished into air, into thin air.

Now, Shale-gas companies may have been impaled on their own bayonets. Yet some would have us believe that natural gas prices are poised for a great comeback–that all the fret and worry is for nothing because prices are going to come right back up and justify the development of all the shale in the country, and then some.

They are wrong: demand will continue to be weak and supply will not be nearly as sparse as the some of the gas bulls would have us believe. Instead, the story of 2009, 2010, and beyond will be not only how much farther natural gas prices will fall, but also how long prices will stay in the basement, and who will be counted among the casualties.

The Fallacy of the Rig-Laydown, Production-Decline Pricing Idea:

U.S. producers, loudest among them being Chesapeake (CHK), are howling that lower prices will eventually lead to less production, which in turn will severely impact supplies and raise the price.

U.S. producers, loudest among them being Chesapeake (CHK), are howling that lower prices will eventually lead to less production, which in turn will severely impact supplies and raise the price.

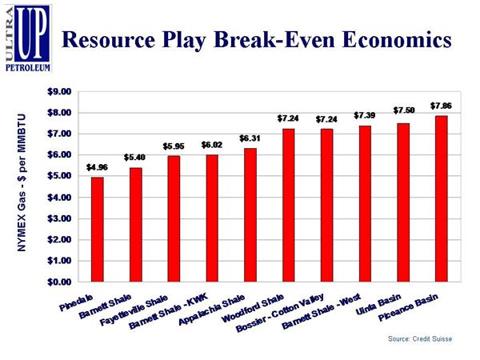

But this is not a process which will lead to sustained greater prices, because even if this phenomenon caused a temporary or seasonal price increase, that would only encourage more production from known, vast shale supplies, and other prolific domestic sources like deep Bossier–which would result in another glut, and bring prices down again. In this scenario, wouldn’t the price just settle at a point which is only marginally better than the cost of production? Its also important to recognize that it takes less rigs actively drilling now to produce more gas than even a few years ago.

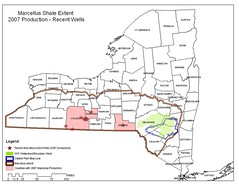

With more built-for-purpose horizontal shale rigs active in places like the Marcellus shale, a few new, successful horizontal units can bring forth a level of production that may have taken 10 or 20 vertical wells to equal only a few years ago.

For example, to date, CXG has drilled 5 horizontal wells with costs declining from $5.3mm for the first well to $3.8mm for the fifth well. The company expects the next horizontal well to cost ~$3.6mm. Average IP-rate for the first 5 horizontal wells was 4.3 MMcf/d. If we assume the lower horizontal well cost of ~$3.8mm with a 3 Bcfe EUR on 40-acre spacing

Another factor which could cut short a price spike is that gas companies may have wells they have shut in and are not producing. They will turn these wells on as prices rise, allowing a rapid flood of natural gas to enter the market much faster than an increase in drilling could respond. It is also likely that if storage reaches capacity there will be no choice but to shut in some production.

In any event, a slight rise in prices into the zone of marginal profitability would likely engender a race to bring on more production in order to realize cash-flow, which could flood the marketplace once again, causing the price settle at or near the break-even point. In this shale-supply driven scenario, prices will go to the marginal cost of production, so any industry gains in efficiency and cost-saving of production will only serve to drive the price down.

(click image to view in separate window)

In the shale-supply driven scenario, big regional shale leaders like Range Resources (RRC) could continue to make money producing high volumes at prices at or near the marginal cost of production, especially since Marcellus gas is usually sold at a Nymex premium in the Northeast market due to savings on transportation.

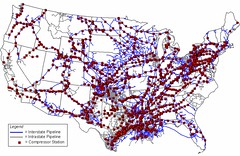

But this scenario does not factor in the burgeoning supply of natural gas headed to the U.S. on foreign-flagged tankers that can deliver as much gas in a month’s transport time as a good shale well can deliver over its entire productive life.

LNG and the Coming Wave of Cheap Foreign Gas...

To continue reading, CLICK HERE.

This is a very troubling article. First of all, I am guessing that most Americans do not know much, if anything, about hydrofracking, nor do they realize what is coming in terms of environmental devastation and hazards to human health. But now, a mammoth global issue comes to our attention: The US will likely be importing LNG from abroad! WHAT? I thought all this gas drilling all over the country was being done to increase our energy independence. Now we read: "...this scenario (shale-supply driven scenario) does not factor in the burgeoning supply of NG headed to the US on foreign-flagged tankers that can deliver as much gas in a month's transport time [!!!!!] as a good shale well can deliver over its entire productive life...." We haven't noticed that the massive new develpoment in overseas gas fields will impact our domestic NG industry. In fact, according to this article, the NG prices will probably return to 1997-1998 levels, and some US gas drilling companies will probably not be able to function because of low marginal profitability. So foreign countries stand to gain the upper hand in the near future. And US companies will suffer. So, as I see it, we are all suffering the destruction of our land, water, air, and quality of life to get ready for NOTHING! If this report is right, great prosperity is not in the cards for the US NG industry or any of the land owners who are hoping for huge profits. All this exploration, preparatory drilling, and pipeline plans will be in large measure for naught. Am I missing something here? Please tell me I am wrong!

ReplyDeleteyes... that seems to be the message...

ReplyDeleteit's an economic merry-go-round... as i've read and posted, the u.s. is shipping our ng to eastern european countries... however, this seeming glut from places like qatar and indonesia puts a question mark on that feasiblity too i would think... moreover, how about our agreement with qatar guaranteeing to buy their lng???

we can surely guess why that deal got made...

sigh.. so many perspectives and pressures feeding the big picture that boils down to a bad idea for Life Itself.

Where can I find more information about the deal with Qatar?

ReplyDeleteCheck out pics 13-16 on NBC's the Today show's website. Link below. I know this doesn't relate to this article, but at least it's in the public's eye.

ReplyDeletehttp://today.msnbc.msn.com/id/30249897/displaymode/1247/

PS. Will be conducting a public awareness forum in Wyalusing in May.

Excellent photos! Thanks! Post the details about the May forum. I might be able to come.

ReplyDeleteyes, they'll never... if you send them to splashdownpa@gmail.com i'll put it up under announcements... and also look forward to attending! nice work!

ReplyDeleteI will definately let you know once all the details have been finalized. Keep up the great work on the site.

ReplyDeletef8r60w5u26 b1h08x2j18 p7z99j2r50 p9e46j8o55 t8o53z8m79 d7p69t6b93

ReplyDelete