By Edith Honan

(Reporting by Edith Honan; Writing by Daniel Trotta; Editing by Cynthia Osterman)

NEW YORK, Jan 5 (Reuters) - Chesapeake Energy (CHK.N) has called proposed New York state regulations for the shale gas drilling industry unnecessarily onerous and likely to scare energy companies out of state, depriving New York of badly needed revenue.

The sentiment was supported by competitor Fortuna Energy, a subsidiary of Canada's Talisman Energy (TLM.TO), which said it was shifting its focus to Pennsylvania because uncertainties in New York threatened to undermine its investments there.

"The measures proposed ... will be more burdensome than any of those placed on our industry throughout the United States," Chesapeake said in public comments made available to Reuters on Tuesday.

As a result, "some operators may elect to focus their risk capital in other states," the company said, which would mean New York would lose potential tax revenue from gas production at a time when the state is looking to close a $3.2 billion budget deficit.

The Oklahoma-based energy company, which on Monday announced a deal to sell a $2.25 billion stake in its Texas shale gas assets to French oil major Total (TOTF.PA), accused the state Department of Environmental Conservation (DEC) regulators of going overboard with environmental protections.

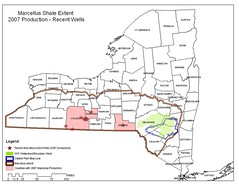

Fortuna said companies faced uncertainty over whether the state would issue drilling permits and it was looking toward Pennsylvania, where exploration of the Marcellus Shale is booming -- but it is also where some of the greatest environmental concerns have arisen.

"New York is facing the loss of at least hundreds of millions of dollars of direct economic impact stimulus and is forfeiting the opportunity to create thousands of new jobs at a time in our state's history when they have never been needed more," Fortuna lawyer Mark Scheuerman told the DEC.

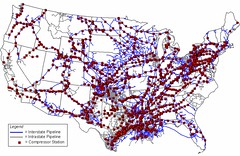

Development of the massive Marcellus Shale in several northeastern states holds the promise of providing the United States with a valuable domestic energy source. But environmental concerns that shale gas drilling contaminates drinking water have created uncertainty for the industry because of the risk of greater regulation.

The U.S. Environmental Protection Agency is scrutinizing shale gas drilling, and the U.S. Congress is considering a bill that would force companies to disclose the chemicals that are mixed with water and sand in the process known as hydraulic fracturing. New York Governor David Paterson proposed opening the Marcellus Shale to the technique. It has been taking place in New York but on a small scale and using relatively minor volumes of water compared to the current industry norm. ... Until now, shale gas drillers in the state have been limited to less modern techniques that yield less energy. HEALTH CONCERNS Environmentalists have raised serious health concerns about the chemicals used in hydro-fracturing, including that they might cause cancer. Neighbors of shale drilling operations in other states have complained their drinking water has become discolored or foul-smelling, their pets and farm animals have died from drinking it, and their children have suffered from diarrhea and vomiting. Chesapeake accused critics of creating "fear and panic" with misleading or incorrect information and concerns "that have no basis in science or reality." Chesapeake's views on the industry took on greater weight in light of its deal bringing Total into Chesapeake's Barnett Shale gas fields in north Texas. That continued a trend in the industry of international oil majors buying shale gas assets. In December, the largest U.S. oil and gas company, Exxon Mobil (XOM.N), agreed to buy shale gas producer XTO Energy Inc (XTO.N) for about $30 billion.

DEMAND ACCOUNTABILITY!

No comments:

Post a Comment