Gary Abdullah, Penn State University

November 17th, 2009

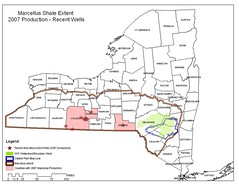

UNIVERSITY PARK - As legislators, environmentalists and others strive to balance the many interests involved in developing the natural gas deposits contained in the Marcellus shale formation, a fierce bidding war has doubled the prices being offered for leases in Pennsylvania. The resulting competition could be a boon for landowners, according to experts in Penn State's College of Agricultural Sciences.

The nation's economic troubles may have slowed development of natural gas wells for the last year, but energy companies seem to be returning to the state and buying up drilling leases with a vengeance. Joann Kowalski, Penn State Extension economic development educator in Susquehanna County, said the proven performance of existing wells may have companies competing to lock up prime properties in the state's Northern Tier.

"Word hit the street in September that Fortuna Energy was going to be paying the Friendsville Group $5,500 an acre for a five-year lease, with 20 percent royalties for producing wells," Kowalski said. "That was probably about twice the rate that had been offered up to that point. Fortuna had not been buying leases in Susquehanna County before this -- they were doing most of their work in Bradford County."

A second company, Chesapeake Energy, is reported to have offered a higher lease rate to area landowners who had not yet signed with Fortuna, according to Thomas Murphy, energy development extension educator in Lycoming County. While actual offers are unconfirmed by the companies, he says the implications are clear: energy companies are making directly competitive bids to the same landowners, hoping to wrap up lease rights in several counties along the Northern Tier.

"Companies have become very competitive to acquire leaseholds that are still available by offering these higher rates," he said. "A lot has to do with the acreage that they can tie up. The Friendsville Group was offering 37,000 acres in Bradford and surrounding counties and lower New York.

...

"Once a company knows what gas is there, there's a sense of urgency to acquire as large a foothold as possible," he said. "Other players are moving into the broader Appalachian region and acquiring or expanding some very large footholds, and with that amount of money flowing in, companies interested in getting a foothold are feeling a greater sense of urgency to capture the remaining pieces. Some other landowner groups are still negotiating with companies, and other groups probably will be forming, but that's hard now because so much of the ground in north-central and northeastern Pennsylvania has been leased."

Kowalski explained... "Large groups that negotiate as one can raise the bar for price; then others can benefit from that, as well. It's also advantageous for the company because there's less effort required to make the deal happen. The group has already gone through the steps of formation, so it makes it easier and less costly for a company to acquire a lot of foothold in one fell swoop instead of going to all the individuals independently. And a landowner group often can provide more contiguous acreage, which is valuable for an energy company."

...

"This is probably the tail end of the initial leasing wave, which has lasted for more than two years," she said. "The amount of land available now is probably pretty small, but this could be repeated as the leases terminate over time. It'll be interesting to see what happens when these leases are up in five years, since the companies will have better well-production records. I believe the companies have found that the wells are producing more than they'd expected, so this could go on for decades."

...

For the complete story, CLICK HERE.

November 17th, 2009

UNIVERSITY PARK - As legislators, environmentalists and others strive to balance the many interests involved in developing the natural gas deposits contained in the Marcellus shale formation, a fierce bidding war has doubled the prices being offered for leases in Pennsylvania. The resulting competition could be a boon for landowners, according to experts in Penn State's College of Agricultural Sciences.

The nation's economic troubles may have slowed development of natural gas wells for the last year, but energy companies seem to be returning to the state and buying up drilling leases with a vengeance. Joann Kowalski, Penn State Extension economic development educator in Susquehanna County, said the proven performance of existing wells may have companies competing to lock up prime properties in the state's Northern Tier.

"Word hit the street in September that Fortuna Energy was going to be paying the Friendsville Group $5,500 an acre for a five-year lease, with 20 percent royalties for producing wells," Kowalski said. "That was probably about twice the rate that had been offered up to that point. Fortuna had not been buying leases in Susquehanna County before this -- they were doing most of their work in Bradford County."

A second company, Chesapeake Energy, is reported to have offered a higher lease rate to area landowners who had not yet signed with Fortuna, according to Thomas Murphy, energy development extension educator in Lycoming County. While actual offers are unconfirmed by the companies, he says the implications are clear: energy companies are making directly competitive bids to the same landowners, hoping to wrap up lease rights in several counties along the Northern Tier.

"Companies have become very competitive to acquire leaseholds that are still available by offering these higher rates," he said. "A lot has to do with the acreage that they can tie up. The Friendsville Group was offering 37,000 acres in Bradford and surrounding counties and lower New York.

...

"Once a company knows what gas is there, there's a sense of urgency to acquire as large a foothold as possible," he said. "Other players are moving into the broader Appalachian region and acquiring or expanding some very large footholds, and with that amount of money flowing in, companies interested in getting a foothold are feeling a greater sense of urgency to capture the remaining pieces. Some other landowner groups are still negotiating with companies, and other groups probably will be forming, but that's hard now because so much of the ground in north-central and northeastern Pennsylvania has been leased."

Kowalski explained... "Large groups that negotiate as one can raise the bar for price; then others can benefit from that, as well. It's also advantageous for the company because there's less effort required to make the deal happen. The group has already gone through the steps of formation, so it makes it easier and less costly for a company to acquire a lot of foothold in one fell swoop instead of going to all the individuals independently. And a landowner group often can provide more contiguous acreage, which is valuable for an energy company."

...

"This is probably the tail end of the initial leasing wave, which has lasted for more than two years," she said. "The amount of land available now is probably pretty small, but this could be repeated as the leases terminate over time. It'll be interesting to see what happens when these leases are up in five years, since the companies will have better well-production records. I believe the companies have found that the wells are producing more than they'd expected, so this could go on for decades."

...

For the complete story, CLICK HERE.

DEMAND ACCOUNTABILITY!

سایت هات بت یکی از سایت های کازینویی است که بسیار معروف است و در صدر سایت های شرط بندی ایرانی قرار دارد. کاربران بسیاری از این سایت استفاده می کنند؛ اما کاربران به دنبال این هستند که این سایت متعلق به کیست؟ باید بگوییم که سلبریتی معروف اینستاگرام دنیا جهانبخت این سایت را بعد از مهاجرتش به ترکیه تاسیس کرد و هم چنان مدیریت و تبلیغ این سایت شرط بندی بر عهده خودش است. اما او هم اکنون در ایالات متحده آمریکا زندگی می کند و توانست سود بسیار زیادی از طریق تاسیس و شرط بندی در این سایت به دست بیاورد.

ReplyDelete