• Rendell says no to gas drilling tax for new budget

Published: September 1, 2009

HARRISBURG - Gov. Ed Rendell is accommodating industry requests and backing away from a state severance tax on natural gas production, which would have added revenue to prop up a new state budget.

While he continues to support a severance tax on gas drilling at some stage, the governor said Monday he has agreed to industry requests to move more slowly on enacting this tax.

"They (the industry) have asked us to go slow," he said at a press conference. "They've asked us to see how they develop."

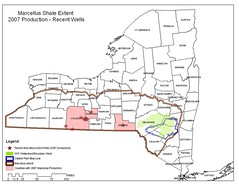

Mr. Rendell proposed a 5 percent severance tax in February to take effect this year, a move prompted by development of the potentially lucrative deep wells in the Marcellus Shale formation, underlying much of Northeast and north-central Pennsylvania.

Mr. Rendell said a severance tax now would bring estimated first-year revenue of $90 million for state coffers, an amount he described as not enough to make or break this year's deficit-ridden budget. Mr. Rendell said he would continue to work for a severance tax, but on a more gradual timetable.

"We are going to work with the industry to try to come up with a fair plan," he added. "We should have a severance tax, but not at the beginning."

The governor's statements came as natural gas prices have declined sharply, to below $3 per thousand cubic feet, caused mainly by a recession-caused drop in demand from factories and manufacturers. Prices peaked at $13 per thousand cubic feet one year ago.

Participants on both sides of the drilling tax debate were taken by surprise at Mr. Rendell's switch.

Rep. Tina Pickett, R-110, Towanda, said it's good news for an industry actively drilling wells in Bradford County.

"If he has come to that conclusion, that is the right conclusion," added Ms. Pickett. "The industry is in the middle of putting a lot of capital dollars in Pennsylvania."

House Democrats will continue advocating for a severance tax in budget negotiations, said Brett Marcy, spokesman for House Majority Leader Todd Eachus, D-116, Hazleton, who has endorsed a severance tax.

Prospective revenue from a severance tax is projected to increase substantially after the initial year, a factor of importance since Pennsylvania faces huge budget deficits for the next three fiscal years, he said.

"There is no reason why we shouldn't be taxing natural gas reserves in the Marcellus Shale," added Mr. Marcy "We believe it is only fair for big oil and big natural gas to pay their fair share."

For more from this report, CLICK HERE.

Viewed from the Morning Call perspective:

• There's One Less Tax On The Negotiating Table.

At a news conference this afternoon, Gov. Ed said he's dropping efforts to pursue a roughly $100 million

At a mid-afternoon news conference, the Democratic governor left open the possibility of pursuing the tax as soon as next year. But he said any new levy would be pursued in consultation with the natural gas industry.

Rendell echoed concerns first voiced by Senate Republicans, saying it's too soon to start taxing an emerging industry that may soon start pumping billions of dollars into the state's still-stagnating economy.

"I think all involved, Democrat and Republican alike, believe that we should eventually have a severance tax," Rendell told reporters. "But not at the beginning. We want to work with people investing in Pennsylvania to get their input."

Asked when the state might have a severance tax on the books, Rendell said "fairly quickly but not this year."

Jan Jarrett, the executive director of the eco-group PennFuture, was less than thrilled by the governor's decision.

She pointed out that the helpless Mom & Pop companies pleading not to be taxed include such defenseless firms as Chesapeake Energy (which posted a Q2 profit for 2009, even though gas prices fell) and those poor lambs at Exxon Mobil, which made a profit of $3.95 billion in the second quarter of the year (down from $11.7 a year earlier).

"From January to the end of June, the industry spent $1 million lobbying the state Legislature," Jarrett said. "It looks like it worked. Everyone's swallowed the industry line that it needs to be coddled."

Read more at themorningcall.com Capital Ideas with John L. Micek blog.

Advocating for the environment, PennFuture's report declares:

• And the loser is: The Pennsylvania Taxpayer

Vol. 11, No. 18 – August 31, 2009

Penn Future Facts

If the Senate Republicans have their way, and the $1 million in lobbying money spent this year by gas drillers has enough Democrats towing the industry line, the state budget crisis will be resolved without the enactment of a severance tax on natural gas drilling. And the loser would be the Pennsylvania taxpayer.

Multi-billion dollar Texas and Oklahoma-based energy companies as well as multi-national corporations like ExxonMobil are rushing to lock up drilling leases on millions of acres in the Marcellus Shale deposit that underlies most of Pennsylvania. The deposit is the largest and richest in North America. One company alone has identified 3,900 potential drilling sites in southwestern Pennsylvania.

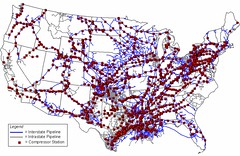

They are all coming here because the Marcellus Shale gas is a bonanza. It has enormous economic advantages over other gas deposits because it is so near to the lucrative and well-developed northeastern markets; the chance of achieving a producing well is very predictable; the wells have high production rates; the gas has a high energy content; and the Marcellus deposit is huge.

Anadarko Petroleum’s president and CEO stated, “The early success from our Marcellus activities indicates this play possesses some of the most compelling economics in our onshore portfolio.” The Marcellus deposit is so productive and costs are so low that the companies can make a profit even at today’s low gas prices.

Pennsylvania is the only state with substantial mineral or gas deposits that does not assess a severance tax to pay for the depletion of a non-renewable resource. And failing to charge a severance tax allows the drillers to foist some of the costs of drilling – damage to roads and bridges, increased demand for sophisticated emergency services, contaminated drinking water supplies, increased demands on environmental regulators – onto the backs of taxpayers.

To add insult to injury, the gas drillers want the state to open up hundreds of thousands of acres of our public forest land to drillers immediately. They want to snatch up leases on public land at a time when the leases can be picked up for a song because of the current low price of gas. And remarkably, Senate Republicans and some blue dog Democrats apparently would rather take that deal than insist on a severance tax that will produce ongoing revenue to the tune of more than half a billion dollars a year by 2014.

To continue reading, CLICK HERE.

DEMAND ACCOUNTABILITY!

No comments:

Post a Comment