pennlive.com

Wednesday September 16, 2009, 5:30 AM

Editorializing in red by Splashdown!

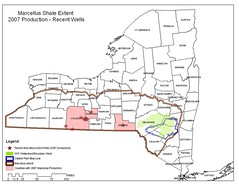

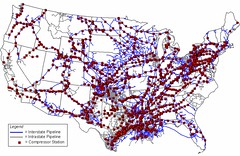

Pennsylvania is poised to be the center of the Marcellus gas industry. Our location, close to pipelines and the big markets on the East Coast, is ideal because its biggest cost is transportation, getting the gas to market.

Remembering the damage left behind by previous extraction of oil and coal in Pennsylvania -- where we taxpayers are still footing the bills, it is only fair that the industry pay its own way this time around.

The gas industry will make billions of dollars. That's a given. Pennsylvania taxpayers should not be stuck paying for the potential damage it does to roads, bridges and our water supplies. Let the gas industry pull its own weight this time around.

The gas industry has been giving two stories:

First, its lobbyists are telling legislators that its infant industry would be devastated by a tax on gas extracted from the Marcellus formation in Pennsylvania.

Second, it tells its investors that Pennsylvania is a sure winner because of the proximity to Boston/NYC markets.

Rep. Bud George, D-Clearfield, has proposed a Natural Resource Severance Tax Act (HB 1489). Of the 14 states with the largest natural gas fields, only California and Pennsylvania do not have a gas severance tax -- taxing what they take from the earth.

... Most of the Pennsylvania companies' operating wells in Pennsylvania are organized as limited liability companies. That means they don't pay corporation taxes but just the personal income tax rate of 3.07 percent, the same tax rate as their average Joe employees who work on the oil rigs.

The oil and gas industry can afford the extraction fees. On the state's Department of Environmental Protection Web site, there is a list of companies now operating in Pennsylvania with more than 100 wells each. There are 211 companies on the list, nine of which have more than 2,000 wells.

The Marcellus shale is going to create a myriad of problems for Pennsylvania, beginning with pumping more than a million gallons of water from our streams to fracture each well -- and the water comes back to the surface much saltier than the ocean, laden with chemicals and dissolved solids that our sewer plants can't purify.(In fact, there are no ways proven safe to dispose of this permanently spent and toxic water. It is water that is no longer part of the hydrologic cycle, subtracted from the world's available supply of water.)

The trucks associated with drilling also will be hard on the roads and bridges -- and the town of Dimock in Bradford [sic] (Susquehanna) County has already seen the impact on the water wells of residents. HB 1489 would ensure that tax dollars be returned to the communities suffering the impact of the industry.

A recent Penn State publication titled "Marcellus Shale: What Local Government Officials Need to Know," indicated that local municipalities will likely face higher demands for services and thus higher costs. Yet they will receive little new revenues to pay for those services. The result could be higher local taxes.

HB 1489 would ensure that the gas industry pays its own way for the impact on the boroughs and townships in Pennsylvania.

Think of the huge taxpayer-funded cleanup of acid mine drainage caused by the coal industry. If the oil and gas industry doesn't pull its own weight, we taxpayers are going to end up paying for the potential damage done by the gas industry.

Richard Martin is coordinator of the PA Forest Coalition.This article appears in its entirety HERE.

WRITE NOW!

No comments:

Post a Comment