BY JAMES LOEWENSTEIN

STAFF WRITER, THE DAILY REVIEW

Published: Friday, July 3, 2009 5:43 AM EDT

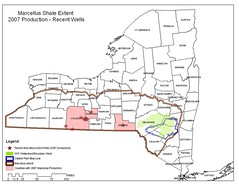

TOWANDA — A Bradford County commissioner warned Thursday that as the state rushes to enact a severance tax on gas drilling, Bradford County — which will be the most drilled-upon county next year in the Marcellus Shale in Pennsylvania — will get only “crumbs” from the tax revenue for its townships.Bradford County will be “the No. 1 drilled-upon county in the state” as far as the amount of drilling that will be taking place in the Marcellus Shale next year, Bradford County Commissioner Doug McLinko said at the Bradford County commissioners’ meeting on Thursday.

Yet if the latest version of the proposed severance tax, which was passed by the House Energy Committee last week, becomes law, the formula for distributing the tax revenue will be “locked in,” and little of the tax revenue will come back to the townships in Bradford County in perpetuity, McLinko said.

“They’ll send back crumbs to our townships and that’s what you’ll get forever,” he said.

The issue of the severance tax was raised at the commissioners’ meeting by Bradford County Republican Committee Chairman Eric Matthews, who asked Commissioner Mark Smith during the public comment period whether he supported the severance tax.

“I think in some manner or fashion we’re going to have to have money going back to the counties — whether that’s from a severance tax, or a property tax paid by gas companies,” Smith said. “I don’t see any other way that the impacts of this (gas drilling) industry are going to be covered.”

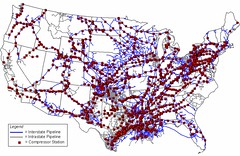

He said the gas-drilling industry will have impacts on roads, bridges, the criminal justice system and the county jail, as well as social impacts.

However, like McLinko, Smith said that he believes the version of the tax that was passed by House Energy Committee — which was a 5 percent severance tax — would not distribute enough of the tax revenue to townships and counties.

The committee voted to keep 60 percent of the revenues from the severance tax for the state General Fund, but split the remaining 40 percent this way: 4.5 percent each to municipalities and counties where gas drilling is taking place, 5 percent for local road and bridge work, 15 percent to a state environmental fund, 4 percent to a state hazardous waste cleanup fund, 2 percent each to the state game and fish and boating commissions, and 3 percent to the state-run heating assistance program.

McLinko said he opposes the severance tax because it will impose a financial burden on gas companies that will either force them to cease drilling or reduce the number of wells they drill.

However, if the state is going to enact a severance tax, “the lion’s share should come back here,” he said.

“It’s our resource, not Harrisburg’s,” he said.

“I think in some manner or fashion we’re going to have to have money going back to the counties — whether that’s from a severance tax, or a property tax paid by gas companies,” Smith said. “I don’t see any other way that the impacts of this (gas drilling) industry are going to be covered.”

He said the gas-drilling industry will have impacts on roads, bridges, the criminal justice system and the county jail, as well as social impacts.

However, like McLinko, Smith said that he believes the version of the tax that was passed by House Energy Committee — which was a 5 percent severance tax — would not distribute enough of the tax revenue to townships and counties.

The committee voted to keep 60 percent of the revenues from the severance tax for the state General Fund, but split the remaining 40 percent this way: 4.5 percent each to municipalities and counties where gas drilling is taking place, 5 percent for local road and bridge work, 15 percent to a state environmental fund, 4 percent to a state hazardous waste cleanup fund, 2 percent each to the state game and fish and boating commissions, and 3 percent to the state-run heating assistance program.

McLinko said he opposes the severance tax because it will impose a financial burden on gas companies that will either force them to cease drilling or reduce the number of wells they drill.

However, if the state is going to enact a severance tax, “the lion’s share should come back here,” he said.

“It’s our resource, not Harrisburg’s,” he said.

No comments:

Post a Comment