Published: June 3, 2010

citizensvoice.com

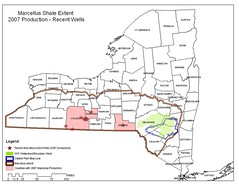

As energy companies have expanded their operations across the Marcellus Shale natural gas field, the industry also has vastly expanded its political activity.

Common Cause reported in May, for example, that the industry vastly has expanded its lobbying activity while entities related to the industry significantly have stepped up their political contributions.

The study found, for example, that industrywide lobbying costs in the state nearly tripled from $579,000 in 2007 to $1.7 million in 2009.

That increase coincides with the growth of the industry and with the Legislature's deliberations on major policy matters relative to Marcellus Shale. It's always difficult to tie lobbying expenditures and campaign contributions directly to policy decisions. But the Common Cause study points out that the 33 House members who recently voted against a moratorium on further drilling leases of state forest land received 3.4 times as much in campaign contributions from industry-related sources as the 42 cosponsors of the moratorium.

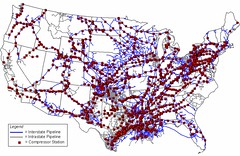

Much of the debate that the industry has sought to influence is the question of whether to impose a "severance" tax on gas extracted from the Marcellus Shale in Pennsylvania. Such taxes are standard in gas-producing states.

The principal argument by tax opponents is that the levy would hinder the industry's development.

That, however, is not likely. And the place that tax advocates should look to prove it is not campaign contributions or lobbying costs, but to the energy industry itself.

Some of the world's largest energy companies have begun to buy up other companies with major interests in the Marcellus Shale in Pennsylvania.

Royal Dutch Shell PLC recently announced the acquisition of East Resources Inc., of Warrendale, for $4.7 billion. East Resources has gas rights for 1.25 million acres from northern West Virginia, across Pennsylvania into New York.

Earlier, ExxonMobil announced the purchase of XTO Energy, another company with substantial Marcellus Shale holdings in Pennsylvania, for $31 billion.

Neither of those global energy giants had invested significantly in shale gas until ongoing exploration and early production across the Marcellus Shale proved its viability and potentially high profitability.

The notion that such companies would invest billions of dollars in the Marcellus Shale, then not exploit the field for fear of a modest severance tax, itself has the substance of gas.

Lawmakers should accept the reality that the people of Pennsylvania should share in the development of the wealth underlying the commonwealth. The debate should about the size of the severance tax, not whether there should be one.

DEMAND ACCOUNTABILITY!

No comments:

Post a Comment