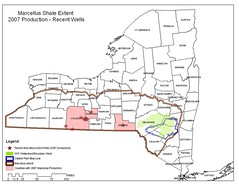

A far-reaching shareholder effort seeks to put environmental issues front-and-center at annual meetings of oil and gas companies active in the Marcellus Shale region.

thetimes-tribune.com

April 12, 2010

Shareholders from environmentally conscious mutual funds, foundations, investment houses and the New York State Common Retirement Fund have successfully put proposals on the annual meeting agenda that would urge more disclosure and transparency of the possible environmental effects and liability risks of hydraulic fracturing. Hydraulic fracturing involves pumping water with chemical additives into a rock formation under pressure to fracture the rock and release natural gas.

Cabot Oil & Gas Corp. and EOG Resources Inc. challenged the shareholder initiative claiming the requests were "micromanagement." The Securities and Exchange Commission backed the shareholder initiatives, which will be put to a shareholder vote.

Other companies receiving the proposal, but not having issued their proxies, include Chesapeake Energy Corp., XTO Energy Inc., and Ultra Petroleum.

The goal of the effort is not to get attention of the public, media, or policymakers. The groups want the attention of shareholders, and by extension, management.

...Typically, any shareholder with more than a $2,000 stake in a company can put certain proposals before shareholders.

Most companies resisted, first by refusing to respond to questions, then fighting to keep the proposal off the ballot. The measures ask management to prepare a report on the environmental impact of fracturing and to set a course for minimizing the chance of environmental harm.

...Management tends to see such shareholder activism as a nuisance. But Rob Whalen, spokesman for $130 billion New York State Common Pension Fund, the force behind the Cabot initiative, said the push for environmental responsibility is in the best long-term interests of the company.

...

The fund reached agreements with Range Resources Corp. and Hess Corp. Range plans to put extensive information on its company Web sites.

"Our hope is that other companies would work with their shareholders the way these companies have," Mr. Whalen said. The fund's negotiations with Chesapeake have collapsed and the company is trying to keep the proposal off the ballot, he said. Discussions with XTO, which is entertaining a takeover bid by Exxon Mobile Corp, have slowed.

In a letter to the fund, Hess agreed to show "public concern regarding the use of chemicals in fracturing and potential risks to the environment and human health." This is a departure from the industry position that conventional fracturing poses little, if any, environmental or health risks.

In their proxy statements, Cabot and EOG Resources Inc., expressed their objection to the proposal, denying any documented case of groundwater being contaminated by fracturing and depicting the process as posing little or no threat to human health or drinking water.

DEMAND ACCOUNTABILITY!

This comment has been removed by a blog administrator.

ReplyDelete