In fact, 39 states now tax the extraction of natural resources, making Pennsylvania (one of the gas wealthiest states in the nation) in the minority when it comes to charging industry with responsibility for reparations necessitated as a result of their activities, and putting McLinko clearly in the minoritiy too.

Whose interests is Dougie Drillbit

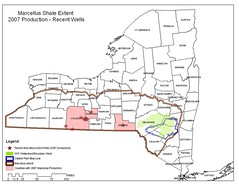

Jan Jarrett, CEO of Penn Future, sees the severance tax as a way of balancing the great opportunity the Marcellus shale play offers with the "tremendous risk to the land, water and wildlife that makes Pennsylvania so special."

A well-structured severance tax on natural gas production will protect Pennsylvania taxpayers from shouldering the public costs that come with increased drilling, according to a Pennsylvania Budget and Policy Center report.

The report, “Responsible Growth: Protecting the Public Interest with a Natural Gas Severance Tax,” examines the potential costs of increased natural gas drilling on taxpayers and the environment, how severance taxes are structured in other states, and what lessons Pennsylvania can learn from them. It can be accessed HERE.

As guest columnist in the Delaware County Times last week, Jan Jarrett made the following observations:

(To read Jarrett's complete statement, click HERE.)

• The tax proposed by Gov. Ed Rendell is identical to the tax paid by the industry in West Virginia. If this tax is onerous, we would expect that Pennsylvania would be the drilling capital of the nation. But it isn’t. Pennsylvania is 15th out of 32 gas-producing states.

• But while this tax will do no harm to the industry, it can do a great deal of good for our state. Natural gas development will bring jobs, investment and money into Pennsylvania’s rural communities, but environmental officials admit that drilling will inevitably result in some damage to our natural resources and communities.

• Careful permitting and oversight can reduce, but not eliminate, the environmental harm. We must have a severance tax that reserves a portion for the environment so taxpayers are not left holding the bag for industry’s damage.

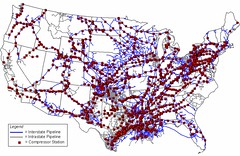

• Without a severance tax that has a portion reserved for local governments, rural areas will have no money to accommodate the influx of workers, their families and additional businesses that drilling will bring.

• Without a severance tax, our state agencies will have no money to protect and enhance the parks, forests, fishing and game areas that are likely to be harmed.

• Without a severance tax, our citizens will lose the natural resources being removed, with no compensation for this permanent loss.

• Without a severance tax, our battered state budget will continue to suffer, with our citizens having to pay larger taxes to cover all the needs of our state.

It's almost a no brainer isn't it?

Tell him you're not satisfied with the way he's representing you!

Not requiring the gas industry to pay taxes is like saying to a child, "You can go to the cookie jar as many times as you want." Not only will the child get a tummy ache, he will also learn that, whatever he wants, he can have without any consequences. Too bad if the cookies run out and no one else can have any. Even if the cookie jar falls off the table and smashes to smithereens (like our environment after gas drilling), it's no problem. Mommy will just get another cookie jar. (Our environment, sadly, cannot be replaced.) Like Doug McLinko says, we wouldn't want the gas drillers to get upset. They might leave and go somewhere else. And the little boy with the cookies must have an endless supply on demand, or else, he will stamp his foot and tell his Mommy, "I don't love you anymore!" That would be very bad. That little boy might run away from home and look for a new mommy.

ReplyDelete