When taking over as mayor of DISH, the first question that was asked by the local media outlets was to respond to the fact that our property values as a whole had decreased considerably from the past year. This is where small towns and cities get the bulk of their funding, through taxes on these property values. Therefore, if the taxable value goes down, naturally the revenue for the town does as well. Now I must say that I am opposed to unnecessary taxation, and therefore have done everything I can to make the taxes here the lowest in the area, and succeeded. However, the town has doubled in size over the last couple of years, yet the taxable value continued to drop. This baffled me how essentially the total value of the town drops every year, while were experiencing massive growth.

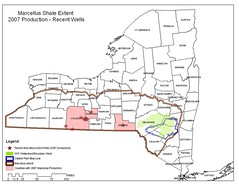

Not only did it baffle me, but it concerned me. As most small towns do, we use the county tax assessor’s office to perform the tax collection service for us, so they were my first call. When they explained the mineral values were the cause of this drop, and that was sixty percent of our tax base, I was again stunned. As you know we are located in the middle of the Barnett Shale, and have had a great deal of exploration in this area. So what would cause the values to continue to drop? This was also during the timeframe when natural gas prices were climbing to all time record highs.

As I investigated the source of the decline in my town it all started to become apparent. The property values not tied to minerals have continued to drop. I believe this is mostly due to the massive natural gas compressors, pipelines and metering stations. They have all but made the surface property here worthless; however, that does not account for the minerals which is over half of our taxable values. I then found that on average, each well drilled loses fifty percent of its production after the first year. That is a huge drop in production in only one year. So that tells me that the only way to maintain the same mineral value is to drill fifty percent more wells every year. So if you have ten wells this year, you would need to drill five more next year just to maintain the same production.

Many of the local cities have went on a sort of spending spree with the new found wealth from the natural gas minerals, and are now finding themselves in a financial crunch. The facts that I taught myself through this simple question from an intui tive reporter has made a world of difference on how I approached this problem here in DISH. We are frugal at best here, making the most of every dollar we get. We have cut the town debt in half, built a massive park, a library, repaved roads and performed substantial upgrades to town facilities and done this while lowering taxes and not dipping into the emergency fund we have in only two years.

To the real point, is what do minerals play into all of this? As previously mentioned we have over half of our tax dollars that come from the minerals, more specifically the revenue we received in 2007 was made up of 56% mineral values, in 2008 that number jumped to 64%. We have not gotten the completed numbers for 2009, but they will likely be similar. The dollar figures for this are 14,500,000 in 2007 and 22,277,000 in 2008 in property values from mineral.

On the surface the benefit from this industry seems huge. We are a small town and they double our value. But I also compare this to the drug “heroin”, due to seeing the other towns which have gotten addicted to the drug and when the drug goes away, (when they price of natural gas goes down 75% as it has), they find themselves in a financial crisis. Also, most people do not take into account how much it costs to have this activity going on. I can only explain what goes on in DISH, TX, but will attempt to explain the drug's side effects.

First and foremost this exploration destroys roads, which are very expensive to maintain and replace. None of the existing roads were designed to withstand the constant pounding from an 80,000 pound waste-water truck. Nor were they designed to handle the larger equipment that is used to drill and refracture the wells. To build roads to handle this traffic can cost millions of dollars.

If the municipality owns the roads, they can force the companies to sign a road use agreement, which forces them to pitch in and help the roads. Most of the cities in the area have agreements like this in place. If they do not, then they are foolish, and are likely costing their taxpayers a great deal of money by not forcing the companies to pay. However, the drilling companies are going to take whatever measures they can to keep from paying damages to the roads. The City of Argyle found out the hard way when they were sued by XTO over road work.

Here in DISH many of the roads are not owned by the town. This is both good and bad; it is good because we don’t have to pay for the major upkeep of these roads. However, if we don’t own the road we don’t have much control either. For example, we have implemented a weight restriction on all of the roads that we do own, but we can not enforce this on roads that we do not own. Unfortunately, the county does not have the capability to force these companies to have road agreements and pay for what they destroy. Therefore, the replacement and repairs come from the general taxation, or bond elections, not directly from the gas companies. So as you might guess it is a juggling match for the counties to keep the roads drivable for the average vehicle.

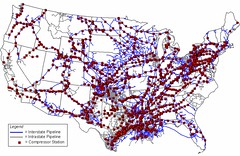

One example of that is Eakin Cemetery Road, which goes through part of DISH, but is owned by the county. A pipeline was being installed in this area, and the equipment used in this process is massive. Please note that the pipelines must be included in the cost of this exploration, even though they contribute little to the towns or property owners, and take a lot in return. I will discuss how bad they hurt the towns later.

When this line went in the companies used Eakin Cemetery Road to access the route. They completely destroyed this road and virtually made in impassible for the average vehicle. You could literally see the grooves where the truck tires that hauled massive equipment went. The pavement was cracked and torn from this equipment and the pipeline companies did nothing to prevent or repair this. And though the county does work hard to keep the roads in reasonable shape, when something like this happens in takes a while to plan the repair; therefore, the citizens here were forced to drive on the impassible road for quite a while until repairs were made.

There is another impact that can be recognized quickly, and that is the affect that the exploration has directly on surface values. I am sure that there are some who believe the propaganda and are fine with having a well or pipeline in their front yard. However, regardless of what you may have heard, they are the exception not rule, especially if you have a small population of mineral owners in your community. The average person will not purchase the property right next to a well site or compressor, providing they are made aware of it. Unfortunately, most of the mineral owners in this area have kept the minerals and moved on to someplace else. However, when they have tried to sell their property with wells and pipelines on them, it has not been successful.

Although you may see a boost in your tax rolls for the short term, you will pay in the long run with the drop in property values. For a small growing community like DISH it especially provides an obstacle for quality growth. There have been four large tracts of property for sale in DISH for several years with no real interest in purchasing the property. If you do manage to get some interest in the property, it will likely be something like a pipeyard or something else that continues to devalue the surrounding property. So getting quality growth in an area that has a large amount of exploration proves to be a large hurdle if not impossible.

The above paragraph dealt with the exploration of the mineral, now we must consider the pipelines, and appurtenances to these pipelines, such as compressors or metering stations. These facilities have dealt us a very harsh blow without giving much in return. This is highlighted by a previous illustration of the pipeyard. The gentleman who unfortunately lives next door to this compressor site sold off a piece of property to a developer who built 18 homes that average around $200,000 each. However, after the compressors were there, he has not been able to give his property away. He was only able to lease some of it to a company that stores pipe. That is the best he can do now, and that in itself is very low quality growth and makes the area even less desirable.

Another illustration that has been used by me before is the gentleman who has had 63 acres for sale now for several years. He purchased the property as an investment, and now has three pipelines and an above ground valve. He can not give this property away. As he reaches retirement age his retirement has been stolen from him. This is no different than Enron or any other scandal, only it has been made legal thievery. There are two other pieces of property that have been for sale for several years, one of which is a large parcel of about 70 acres and the other is about 10 acres.

The above examples are heart wrenching when you look at how much it has cost the property owners, and only one of the above mentioned owners has any substantial mineral interest. Therefore, they others are merely victims of circumstance. However, as this gets to the point of whether this all is really worth it, I believe that if all of these property were sold and developed it would add somewhere around $20,000,000 in property values, which is more than the average in mineral values over the last few years. I also believe this is a very conservative estimation, it could be more.

So would you rather have homes than minerals? Homes in theory will increase in value over the long term while minerals will drop. Although, this has not been case the last couple of years, in the long term this has held true. Also, natural gas is a commodity, and its prices are much more volatile than housing. For example in the last couple of years the lowest price of natural gas is about 25% of the highest; therefore, you have seen a 75% drop in prices in a little over a year.

In DISH we have focused on overcoming the boom and trying to get quality development. We have worked with a number of developers to annex their property into the city. All three of the major annexations we have had since I became mayor, have been solely to protect them from the development of the minerals and total destruction of the surface values that accompany it. This is not saying that we do not allow drilling; we just force the companies to do it responsibly. We have a pad site that is right in the middle of one of these subdivisions and it really does not look that bad. It is lined with an eight foot concrete fence and most of the stuff inside including the tanks is not visible beyond the fence. However, the companies will only do this when they are forced too, they will not volunteer it.

So how about all those mineral owners who have gotten filthy rich? Here in DISH there have been some folks who have made a great deal of money on the minerals. However, most of them had lived here their whole life, and had property handed down over the generations, otherwise they only have a small portion of the mineral rights. Therefore, there are only a few that are still alive that have a major portion of the mineral rights, and as previously stated most of them have moved away to someplace that they do not have to deal with the mess that is left behind.

This area was the beginning of the Barnett Shale, if I am not mistaken the first gas producing well in the Barnett Shale, was within 20 miles of DISH. Therefore, the minerals were purchased several years ago, and the leases were quite low in comparison to the massive leases signed last summer. The lease here is somewhere around 16% royalties with anywhere from $1,000 to $1,500 per acre, not the 25% and $25,000 per acre that have been publicized.

So what does the 16% royalty get you? From what I understand, for someone who owns four acres and has a quarter of the mineral rights, they average less than a $100 a month. Therefore, if you have one acre with 100% of the minerals you would get something similar. Therefore, unless you have a massive amount of land with 100% of the minerals, you are not going to get much money. If you are part of the lease, you must also consider the truck traffic, odor, noise, and you just might be fortunate enough to have a high pressure gas pipeline run through your front yard. All of these things accompany the hundred bucks a month. I do not have any mineral rights, if anyone has another illustration please add it to this posting.

So to the point of, is the juice worth the squeeze? From my perspective as a small town mayor and a property owner, I say no! Not in the manner in which it is being done in Texas. I think that with minor regulation it could both provide the natural resources that we need as well as not totally destroying the surface values and destroying the growth of these areas. For example, there is no process in Texas for the laying or routing of pipelines. The pipeline companies can literally put them anywhere they want without concern for surface owners and other natural resources. Municipalities do have some limited control over the placement of the wells, but not the pipelines.

The items that were discussed were only the things that are easily recognized. I am still learning the affects on air and water quality and to explore the possible health of affects of this exploration. Although I have recently learned that the companies with the compressor site have learned a loophole that allows them to virtually go without regulation in regards to the air emissions they produce. I will share more on this subject as I figure out the specifics. I have the documents; I just have not digested everything yet.

This also does not include the tens of thousands of dollars in legal fees it takes to offer the citizens some minor protection from these companies. Nor does it take into account the hundreds of hours of my time spent researching and campaigning for more regulation for no pay. So you must ask yourself; is the juice is worth the squeeze? I can support any statement that was made in this posting; therefore, if you have more specific questions, please let me know and I will clarify it for you. To those of you who have visited DISH, I doubt you have any questions in regards to the impact the Barnett Shale has had on us.

Calvin Tillman

Mayor, DISH, TX

(940) 453-3640

"Those who say it can not be done, should get out of the way of those that are doing it"

No comments:

Post a Comment